Gold prices in Pakistan saw a modest decline on Friday, April 18, 2025, as per the latest figures shared by the All-Pakistan Gems and Jewelers Sarafa Association (APGJSA). The price of 24-karat gold dropped by Rs300 per tola, now being traded at Rs349,700.

For those unfamiliar, a tola is a traditional South Asian unit of mass used to measure precious metals like gold and silver. In terms of grams, the price of 24-karat gold per 10 grams also fell slightly, decreasing by Rs257 to settle at Rs299,811. Likewise, 22-karat gold, which is commonly used in jewelry, is now being sold at Rs274,836 per 10 grams.

This slight dip in gold prices is seen as a result of both local market fluctuations and subtle changes in the international market. While the gold rates fell domestically, the international market didn’t show much volatility. Spot gold globally was trading near $3,315 an ounce, marking a marginal increase of $1.2, or 0.04%, from the previous day.

Also Read: Dubai Gold Prices Today – 18 April 2025 (Updated Rates in AED & USD)

Interestingly, silver prices in Pakistan moved in the opposite direction. The cost of 24-karat silver increased by Rs16 per tola, now priced at Rs3,417. On a per 10-gram basis, silver saw a Rs14 rise, reaching Rs2,929. This uptick in silver prices contrasts the fall in gold, possibly due to differing demand trends or market dynamics influencing each metal separately.

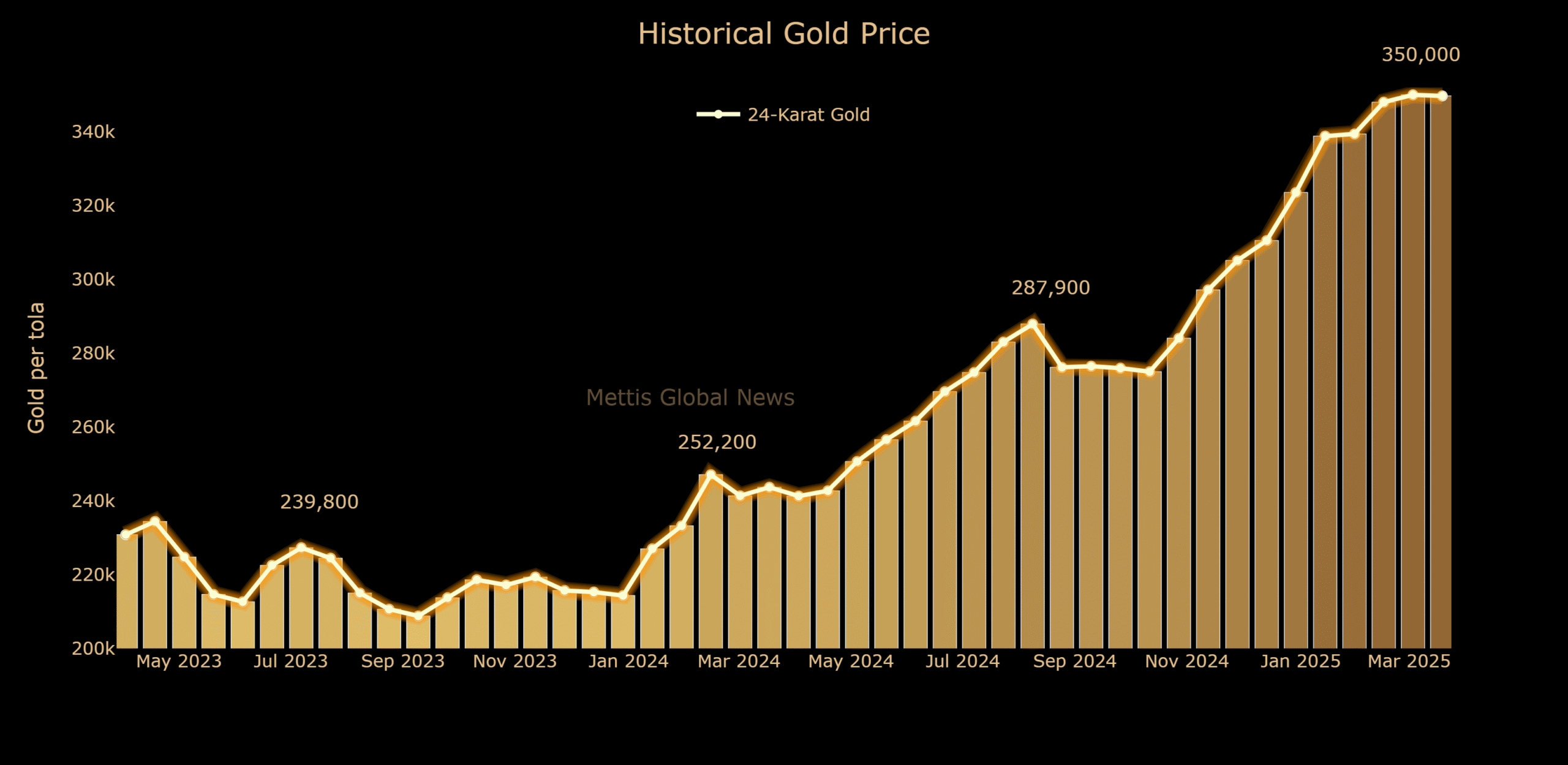

Over the fiscal year to date, gold has experienced a substantial increase, reflecting the overall bullish sentiment that has driven prices up by Rs108,000 per tola. However, such minor day-to-day fluctuations are normal and can be influenced by several factors including currency exchange rates, global market trends, and geopolitical developments.

For buyers and investors, this Rs300 dip may present a small window of opportunity, especially for those waiting to make purchases before another potential hike. However, market watchers suggest keeping an eye on global gold trends, as international shifts continue to play a key role in local pricing.

As always, it’s wise to stay informed and consult with trusted jewelers or financial advisors before making significant gold investments.